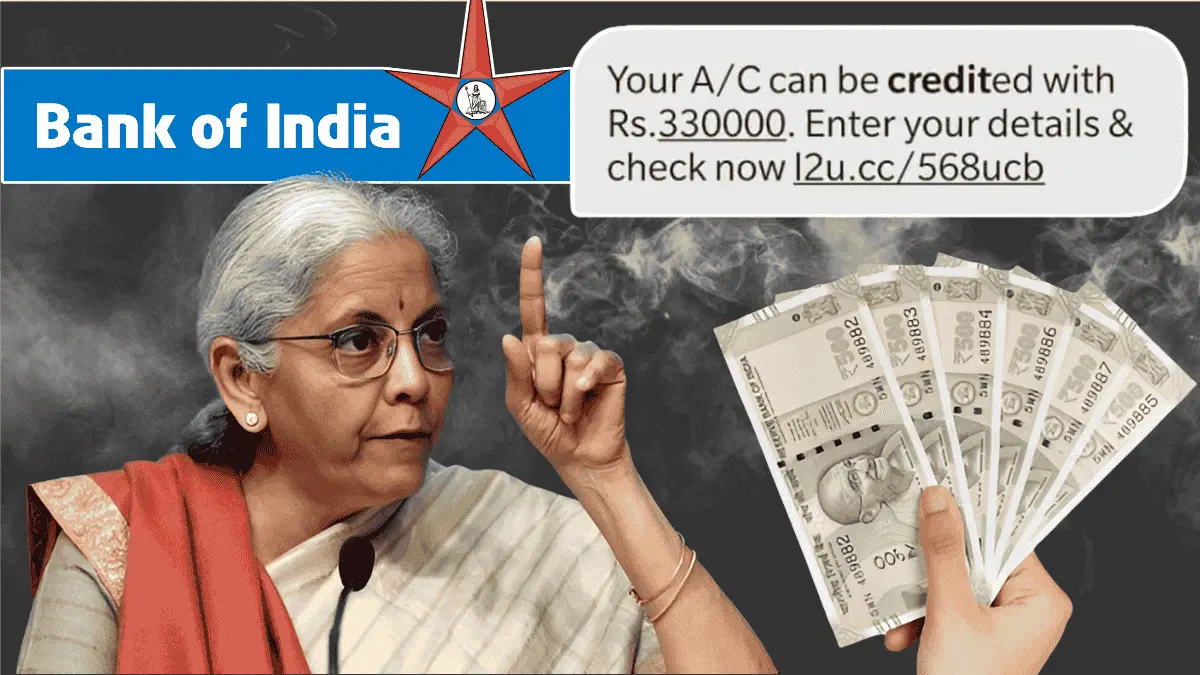

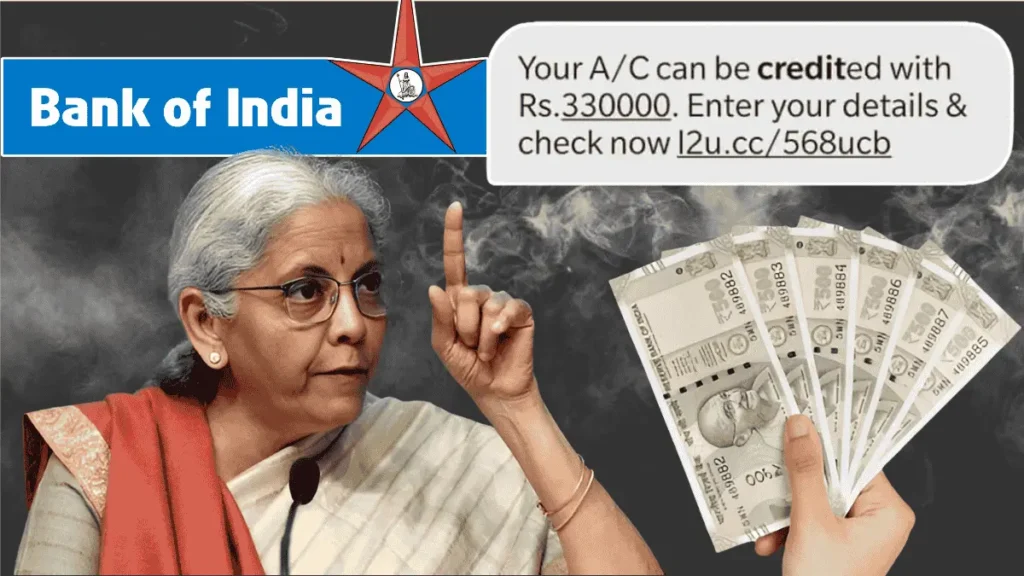

A message promising ₹2 lakh appearing in your Bank of India account has been making the rounds on social media and in chat groups. It sounds exciting, even plausible when presented with screenshots and urgent captions. But when money talk goes viral, caution is your best ally. Here is a clear, practical look at what is true, what is misleading, and how to protect yourself while checking the facts.

₹2 Lakh BOI Claim

The claim generally says that every Bank of India customer will receive ₹2 lakh, either as a new government benefit, some special BOI initiative, or because of a Reserve Bank directive. Some versions urge you to click a link, update KYC, or share an OTP to “unlock” the amount. Others show edited passbook images or old news clips that seem to validate the promise. The bottom line is simple: banks do not randomly credit lump sums, and any blanket offer of ₹2 lakh to all BOI customers is not a genuine program.

Where Buzz Came From

Such messages often start from misread policy updates, recycled old posts, or opportunistic scams piggybacking on real schemes. A past announcement about insurance coverage or a government relief payment to a specific group can be twisted into a universal payout claim. Once a few convincing screenshots circulate, the story spreads fast, and each forward adds a little more certainty to something that was never true in the first place.

What Banks Actually Do

Banks move money only when there is a valid reason and a traceable instruction. Credits show up from known sources such as salaries, transfers, refunds, interest, dividends, or government benefits for which you are explicitly eligible. Every entry carries a narrative, UTR, or reference, and the bank’s systems are audited and regulated. If a payment genuinely comes from a government scheme, it will appear as a standard Direct Benefit Transfer with a recognizable description, never requiring you to click a random link or share confidential details to “activate” funds.

Government Scheme Reality Check

There is no universal government program that deposits ₹2 lakh into every BOI account. Popular welfare schemes pay targeted amounts based on eligibility, and these values are typically far smaller than ₹2 lakh. Some state or central relief measures may provide larger compensation for specific circumstances, such as accidents or disasters, and those are processed case by case with documentation and approval. If you have not applied or do not meet criteria, a lump sum will not arrive out of the blue.

Insurance Covers In Context

Many bank-linked insurance products mention ₹2 lakh, which fuels confusion. Under Pradhan Mantri Jeevan Jyoti Bima Yojana, eligible subscribers receive life cover of ₹2 lakh for a small annual premium, while Pradhan Mantri Suraksha Bima Yojana provides accidental cover up to ₹2 lakh. These are insurance benefits paid to nominees upon claim, not surprise credits to living account holders. Some RuPay debit cards also include accidental insurance cover, often contingent on recent card usage and subject to terms. These protections are valuable, but they are not automatic cash payouts to your account.

Deposit Insurance Versus Payouts

Another misunderstanding comes from deposit insurance. Deposits in Indian banks are insured up to ₹5 lakh per depositor per bank, but that protection is relevant only in rare cases of bank failure and follows a regulatory process. It is not a routine or proactive credit. The insured amount does not mean money will appear in your account today; it simply defines your protected limit if the worst happens and the payout is triggered by the insurer through formal channels.

Jan Dhan Account Angle

Jan Dhan accounts often sit at the center of such rumors because they are linked to financial inclusion and multiple benefits. These accounts can receive genuine government transfers and may come with insurance or overdraft facilities. However, a viral statement that every Jan Dhan account will receive ₹2 lakh in cash is not accurate. Where ₹2 lakh does appear in related materials, it almost always refers to insurance cover or compensation under specific circumstances, not everyday credits.

Why Rumors Gain Traction

Big round numbers travel fast because they offer hope and clarity in a complex financial landscape. When policies change and headlines move quickly, it is easy to mix a real benefit with an unrelated number and create a persuasive story. Scammers exploit this gap in understanding by crafting messages that look official, include deadlines, and tap into fear of missing out. The result is a perfect storm where a false claim feels both urgent and credible.

How To Verify Claims

If you suspect a payment is real, start with your own records. Log in to official Bank of India channels only, such as the mobile app or net banking, and check the transaction narration. Review SMS alerts from recognized sender IDs and confirm that any credit has a clear source. If in doubt, call the bank using the number on your card or visit a branch and ask for the origin of the transaction. Never rely on forwarded links, unverified websites, or messages that request personal credentials to unlock a supposed benefit.

Red Flags To Notice

Treat any message that asks for your OTP, debit card PIN, net banking password, or UPI PIN as malicious. Be wary of shortened links, unofficial domain names, and apps shared via direct download links. Watch for pressure tactics, such as expiring offers or threats of account blockage, which are classic social engineering tricks. Pay attention to spelling errors, inconsistent dates, and screenshots with cropped edges, which often signal fabricated proof rather than real bank communication.

If Money Appears Suddenly

Occasionally, accounts do receive mistaken credits. If that happens, do not spend the funds until you identify the source. Check the description in your statement and contact the bank for clarification. Banks can and do reverse erroneous credits, and knowingly using someone else’s money can lead to legal trouble. If a caller claims the money is theirs and asks for a refund, insist on coordinating through the bank rather than transferring funds on your own, and never share sensitive data during such calls.

Final Word On Buzz

The headline promise of ₹2 lakh appearing in your BOI account is not a blanket truth. Real benefits exist, but they come through defined programs, with clear eligibility and traceable entries. Insurance covers of ₹2 lakh are meaningful safeguards, not surprise cash windfalls. When a claim sounds dramatic, step back, verify through official channels, and keep your credentials to yourself. Confidence with facts is the best defense against both disappointment and fraud.

Disclaimer

This article is intended solely for informational and awareness purposes. The facts, examples, and explanations provided are meant to help readers stay alert to misleading messages and potential scams circulating on social media and messaging platforms. This is not an official statement from any bank, government agency, or financial institution.